Update Payment Plans

Navigate:  Tax > Accounts Receivable > Payment Plans > Update Payment Plans

Tax > Accounts Receivable > Payment Plans > Update Payment Plans

Description

This task updates the plan status from Active to Defaulted if the required payments have not been made, and when plan payments are held as surplus (not applied to bills), it applies the payments to the bills and updates the plan status from Paid to Fulfilled when there is enough payment to pay off the plan.

Steps

-

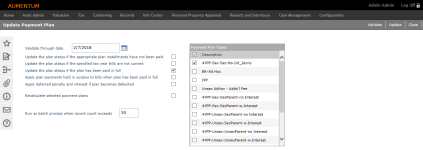

On the Update Payment Plan screen, select one or more items in the Payment Plan Types panel.

- Enter or select a date in the Validate through date field.

- Select the checkbox for one or more options, as applicable.

-

Update the plan status if appropriate plan installments have not been paid – if selected (TRUE), any plan installment due on or before the Validate Through Date must be paid in full, else the plan will default,

-

Update the plan status if the specified tax year bills are not current – TRUE if selected. For example, if the specified tax year is 2016, the last installment due must be current, meaning that the 2016 bills that are not in a plan must have the last installment paid before the due date.

-

Update the plan status if the plan has been paid in full – if selected (TRUE) and payments are held in surplus and there is enough to pay off the plan, then payments are applied and the plan status is set to Fulfilled.

-

Apply deferred penalty and interest if plan becomes defaulted – if selected (TRUE), then the plan becomes defaulted and penalty and interest is charged on the bills that were in the plan.

-

Click Update or Validate in the Command Item bar.

- A pop-up will ask you to verify that the Validate Through Date is correct. Click OK to continue, or Cancel to close the pop-up and modify the date.

- On the Plan Update Results screen, you can view a summary of the plan update and print the plan update.

- Click Previous to return to the Update Payment Plan screen.

- Click Close to end the task.